1-1. Step 1: Confirmation of registration information

## The following pages have been translated by a machine translation system.

## Please note that the machine translation system does not guarantee 100% accuracy.

Click on “扶養控除等申告書一括申請(年末調整)” , confirm your personal and family information and enter your income and other information.

What to do on this screen

- Check your personal and family information registered to the university

- If necessary, apply to update your personal information

- Calculate your and your family’s income

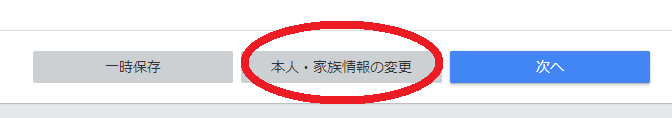

You need to change your family information from 「本人・家族情報の変更」at the bottom of the screen. It may take some time to be approved. Please apply for changes well in advance, as you cannot reopen your year-end adjustment application until it is approved.

If you want to interrupt your input, press the “一時保存” button at the bottom of the screen.

Next time you want to continue with the application, click the “再開” button.

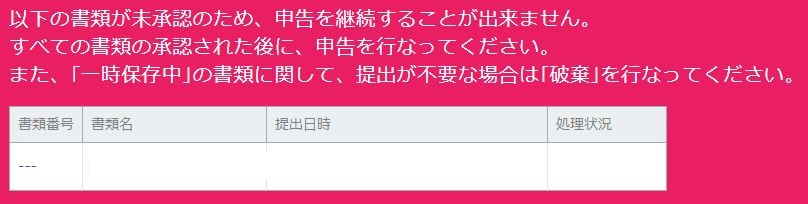

【Attention】If you get the following error

Some applications in the middle of the process may have been left in temporary storage, and this may prevent you from proceeding.

Go back one step from “ホーム” in the upper left corner of the application screen for year-end adjustment to the screen labeled “COMPANY”. After that, check the temporarily saved documents from the “一時保存書類一覧” in the upper left corner, and 「破棄(discard)」 them if they are not needed.

Confirmation of personal information

Make sure your address is collect. Please register the address where the “Certificate of Residence” is located.

If there is a difference between your address and that of the following year, it will be shown in two columns.

*On the confirmation screen, you may be asked to enter the “世帯主” and “世帯主の名前,” but you may leave these fields blank.

Confirmation of the individual’s disability information

If you have any changes, you cannot modify them directly on this screen.。

Click on “本人・家族情報の変更” at the bottom of the screen to request a change.

If there are no changes, continue down.

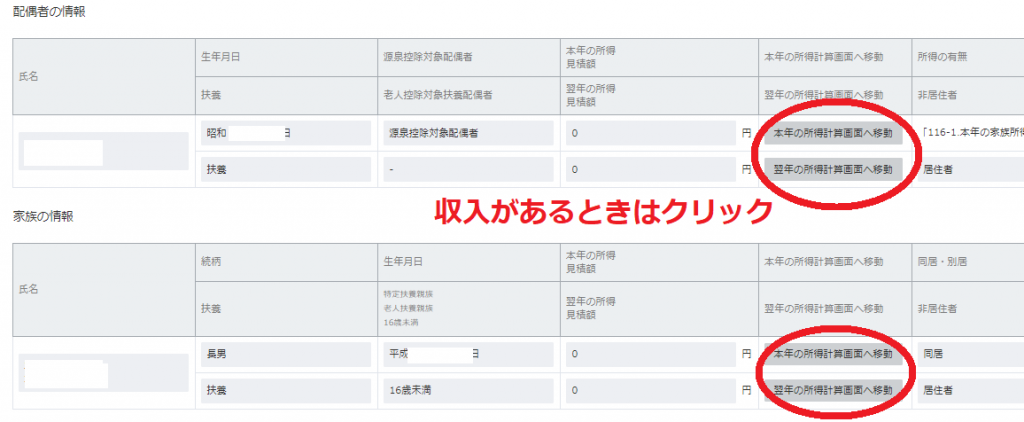

Confirmation of spouse and family information

If you and your family have income, press the respective “…の所得計算画面へ移動” button. See “1-3.Input on the income calculation screen” for details.

※In order to determine whether the family member is eligible for the exemption for dependents, the income of the family member should be calculated.

※If eligible for a Flat-amount Cut of Personal Income Tax FY2024 (income of less than 480,000 yen) and have income, please be sure to enter this information.

You do not need to enter this information if you do not qualify the family member for the exemption for dependents.

If there are changes, they cannot be modified directly on this screen.

Click on “本人・家族情報の変更” at the bottom of the screen to request a change.

If there are no changes, continue down.

![]()

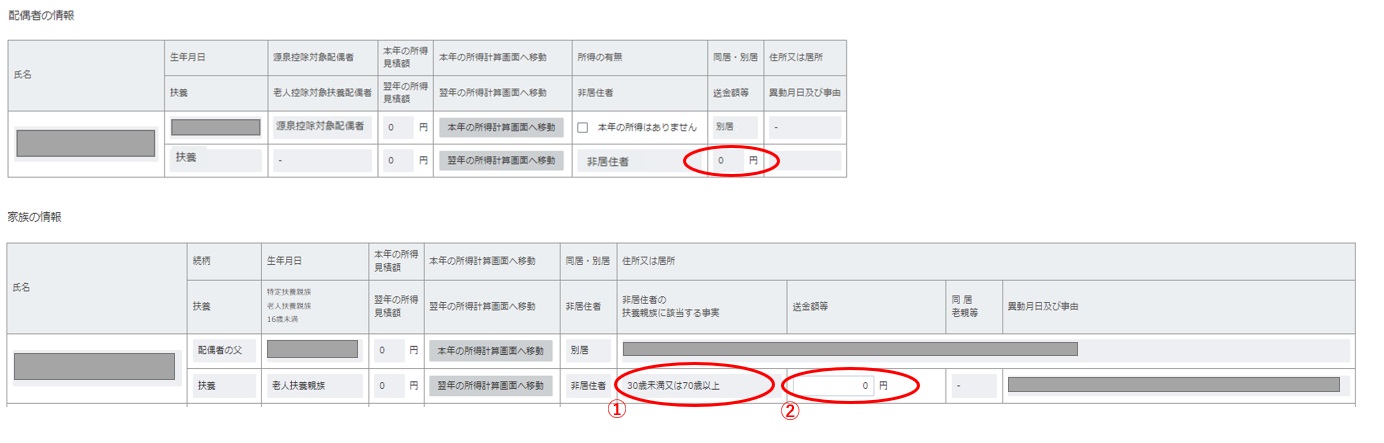

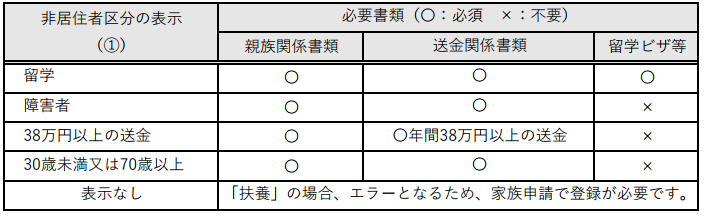

Confirmation of information on family members residing outside the country

1) Verify the information of family members residing outside the country (“non-resident”).

The deduction will be applied by submitting the required documents separately as follows.

A. Spouse: Documents related to the spouse and remittance details

B. Dependents (other than spouse): Documents corresponding to the following categories

●Submission of Required Documents:

-For faculty and staff members who are eligible, please follow the instructions provided by the Salaries and Welfare Section in advance.

-If any of the following applies to you, please submit the required documents enclosed in the return envelope for the year-end adjustment.

(1) Applying for dependents residing outside of Japan for the first time

(2) Registered dependent is changed to a non-resident

(3) Prior application has not been completed

-If your dependents (other than spouse) do not fall under any of the above categories and the category① is left blank, you must apply for a change of status to “not eligible for tax deduction” from the “Change of personal/family information” application form.

![]()

*If your non-resident dependents (other than spouse) are “between 30 and 70 years old” and do not fall under the categories of “studying abroad” or “disabled”, the “annual remittance of 380,000 yen or more” is eligible for the deduction. In this case, please change the “Non-resident status” to “Remittance of 380,000 yen or more” from “Notification of change in family information (non-spouse)” screen.

*If you wish to change your spouse’s information, please apply for the change through the Spouse Information Change Form.

*In the case of a change application, please temporarily save the year-end adjustment as the application for year-end adjustment cannot be filed until the application is approved.

2) Enter the amount of remittance

-If a non-resident relative is eligible for the deduction, please enter the amount of remittance. If the amount is not entered, an error will occur and you will not be able to proceed to Step 2.

-If the category is “remittance of 380,000 yen or more,” an error will occur and you will not be able to proceed to Step 2 unless the remittance amount of 380,000 yen or more is entered. (For spouses, there is no category to select.)

Number of tax exemption for dependents

Make sure you have the right number of tax exemption for dependents

-300x93.png)

【NOTICE】

If you make a change in the “家族情報の変更”, the number of people in your family will not be reflected in your application until it is approved. Please suspend your application until you receive approval.(There is a “一時保存” button at the bottom of the screen. You will receive an automatic e-mail notification of your approval.

Entering and confirming the amount of the person’s income

Even if you have no dependents or no deductions for insurance premiums or home loan, you still need to enter your own income.

Click on “所得計算画面へ移行” to calculate your income for this year and the following year. See “1-3.Input on the income calculation screen” for details.

Click on “所得計算画面へ移行” to calculate your income for this year and the following year. See “1-3.Input on the income calculation screen” for details.

*From 2020, the basic deduction will also have to be filed. If you do not enter the amount of your income, the “amount of basic deduction(基礎控除の額)” will be 0 yen, and your tax will be higher.

*「所得金額調整控除の額」: This deduction is only available to those with an employment income of 8.5 million yen or more and a child under the age of 23 or a special disability (for you or a family member).

Please be sure to enter the information for the following persons.

・Those who receive a spousal exemption(配偶者控除) or special spousal exemption(配偶者特別控除)

・If you have a spouse who is eligible for withholding tax exemption(源泉控除対象配偶者)

・Those who receive the Income Amount Adjustment Deduction(所得金額調整控除) …In this case, enter your income of 8.5 million yen or more)

*Check last year’s withholding tax form for the amount to be entered under “収入”.

This deduction is only available if your salary income is 8.5 million yen or more and you have a child under the age of 23 or special disability (you or a family member). Please refer to the 国税庁の 説明.

If this applies to you and the amount is 0 yen, you need to apply for a change by clicking the “「本人・家族情報の変更」” at the bottom of the screen.

This is a new system starting in 2020. In order to apply this system, you need to register your family information even if you did not need it before.*Note :Unlike the deduction for dependents(扶養控除), this deduction is not restricted to be applied to only one of the income earner in the same household. Therefore, for example, if both husband and wife have an income of more than 8.5 million yen from wages and other sources, and the couple has one dependent child under the age of 23, both of them may be eligible for this deduction.”

Save and Next

Please check the content and press “次へ”.

If you want to interrupt your input, click the “一時保存” button.

If you want to continue with the application, click the “再開” button.

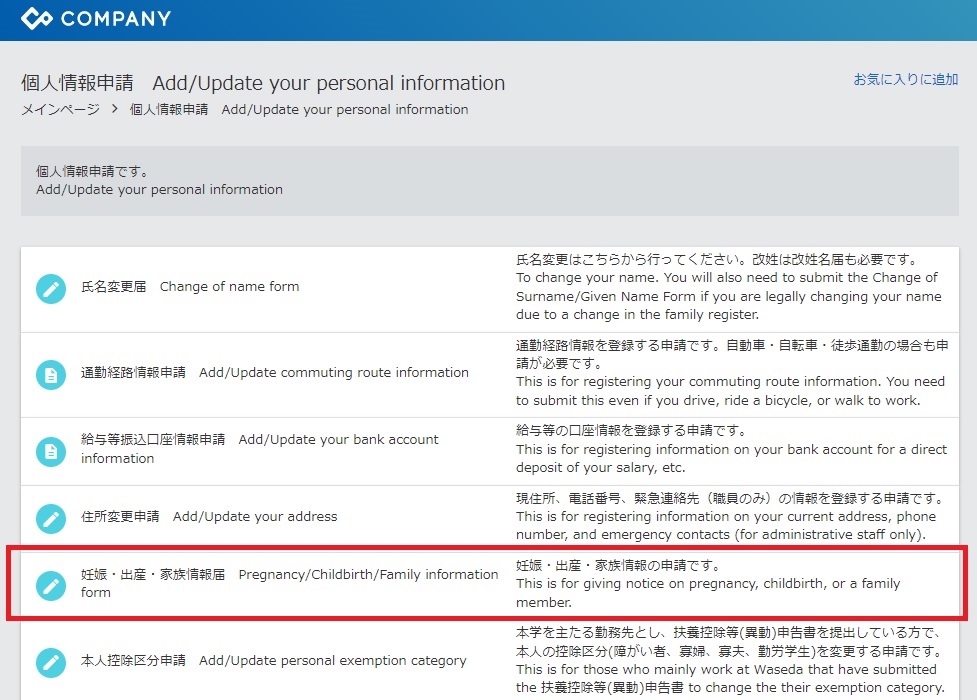

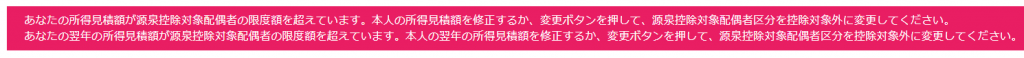

【Attention】If you get the following error

The error is that your spouse is not a spouse eligible for withholding tax deduction (源泉控除対象配偶者)because your estimated income is too high. Please take one of the following actions.

The error is that your spouse is not a spouse eligible for withholding tax deduction (源泉控除対象配偶者)because your estimated income is too high. Please take one of the following actions.

- Correct your income estimate to below 9 million yen (10.95 million yen in salary income).

…If your actual income exceeds this amount, it will be adjusted at the end of the year, so there will be no loss or gain throughout the year. - Change your spouse’s information by clicking the “本人・家族情報の変更” button at the bottom of the screen. (This can be resumed after approval by the Personnel Division.

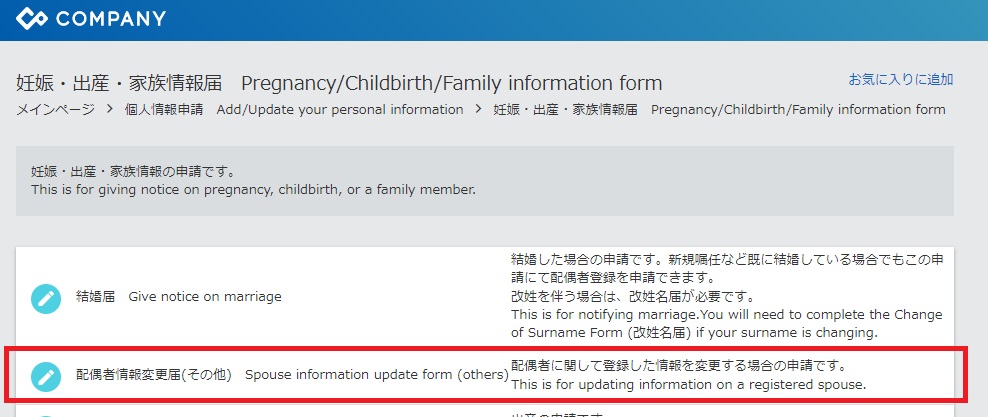

「個人情報申請」 ->「妊娠・出産・家族情報届」 -> 「配偶者情報変更届(その他)」 -> Write “源泉控除対象配偶者を対象外とする” in the 「変更内容欄」 -> “次へ” -> “送信”

Write “源泉控除対象配偶者を対象外とする” in the 「変更内容」box. Be sure to click on “Next.

![]()

On the confirmation screen, scroll to the bottom of the screen and click “送信”.

Once you have received approval from the Personnel Divisiton, you can resume your year-end adjustment application.

6.Q&A

| Q1 | I do not know the amount of income earned by the University. |

| A1 | The estimated amount is acceptable. If you report your spouse as eligible for the spousal deduction and withholding spouse, the deduction will be automatically determined whether you are eligible for the deduction after the final determination of your annual income at the University. |

| Q2 | When you enter the estimated total income for the current year and press the “次へ” button, the message “あなたの所得見積額が源泉控除対象配偶者の限度額を超えています。本人の所得見積額を修正するか、変更ボタンを押して、源泉控除対象配偶者区分を控除対象外に変更してください。 “. What does the “変更” button mean?。 |

| A2 | This refers to the change request from “本人・家族情報の変更” at the bottom of the screen. If you wish to change your spouse’s deduction classification, please follow the steps below. 1)Login to My WASEDA In the home page, go to “人事システム” -> “申請・照会” 2) The screen will switch to the new human resources system COMPANY screen. Go to “個人情報申請” -> “妊娠・出産・家族情報届” 3) Go to “配偶者情報変更届” and submit the form. Please enter the information to be changed in the “変更内容” field.ex.) Exclude the spouse category from the withholding deduction. |

| Q3 | I don’t know the estimated income for the following year. |

| A3 | You may use the estimated amount. Please enter this information as it is needed to calculate the income tax for the following year’s monthly payroll. |