1-3.Input on the income calculation screen

## The following pages have been translated by a machine translation system.

## Please note that the machine translation system does not guarantee 100% accuracy.

This page is an explanation of the screen for calculating your personal and family income in “Step1.登録情報を確認する”.

Even if you have no dependents or no deductions for insurance premiums or home acquisition, you still need to enter your own.

If you have completed “Step1.登録情報を確認する”, please go to “Step2. 保険料控除を申告する“.

Entering the income calculation screen

Click the “所得計算画面へ移行” button to open the following screen.

As this is a requirement for various deductions, please take the time to enter your information.

1 Enter the income, 2 Press the “自動計算する” button.

3 Check the calculated total income, 4 Click “一覧に戻る”button.

Please not that if you don’t click the “自動計算する” button, the calculation will not be saved.

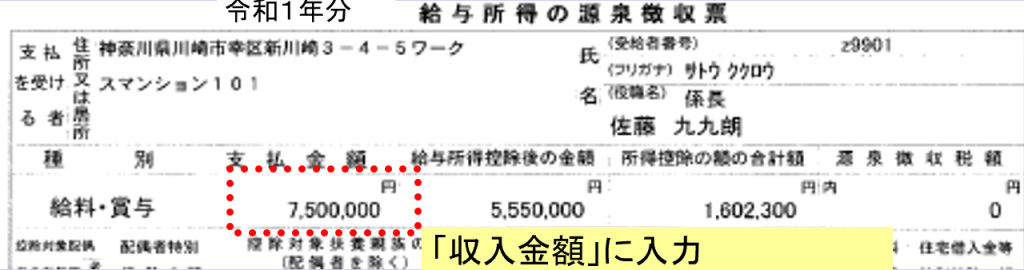

Amount to be entered into payroll income

1.If your income is about the same as last year’s and you have last year’s withholding tax form

Please enter the amount of money you paid on last year’s Gensen Choshuhyo (Certificate of Withholding Tax).

You can check last year’s Gensen Choshuhyo (Certificate of Withholding Tax) issued by Waseda University by the following route.

MyWaseda Left menu「人事システム」-「申請・照会」-「給与情報照会」→「源泉徴収票照会」

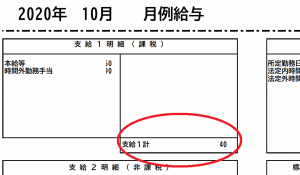

2.If you have a certain amount of income each month

You can enter the information from the “支給1計” section of your pay slips.

Pay slips issued by Waseda University can be checked in the following way.

MyWaseda Left menu「人事システム」-「申請・照会」-「給与情報照会」→「給与照会」

【What to include in the estimated amount of income】

If you have any income other than that of the University (including retirement benefits), please enter the estimated amount (income, expenses, etc.) for this year, and click the “Automatically calculate” button.

Medical benefits for unemployed persons must be included in employment income.

【What is not included】

Please do not include benefits from Hello Work (unemployment, nursing care leave, and childcare leave) and lump-sum payments for childbirth from the health insurance association in your income.

【NOTICE】

If you have income (including retirement benefits) not from the University, please enter your estimated income and expenses for this year in the appropriate boxes and click the “自動計算する” button.

If the income of your dependent exceeds 480,000 yen, he/she cannot be declared as a tax-deductible dependent.

If your spouse’s income exceeds 950,000 yen, you cannot declare him/her as a spouse eligible for tax deduction(源泉控除対象配偶者) .

Click “一覧に戻る” and change the ★税扶養控除区分★ from “Change of personal/family information(本人・家族情報の変更)” at the bottom of the screen.