1-2. Request for change in personal and family information

## The following pages have been translated by a machine translation system.

## Please note that the machine translation system does not guarantee 100% accuracy.

Request for change in personal and family information

This page explains when you need to change your personal and family information in 1-1. Step 1: Confirmation of registration information

If you have already completed “1-1. Step 1: Confirmation of registration information” or you do not need to change any information, please go to “Step 2: File a insurance premium tax credit“.

【NOTICE】

Your personal information request will be reflected upon approval by Human Resources. Until the approval is granted, the application will not be reflected on the year-end reconciliation application page and the application cannot be reopened. Please make sure to submit your application well in advance.

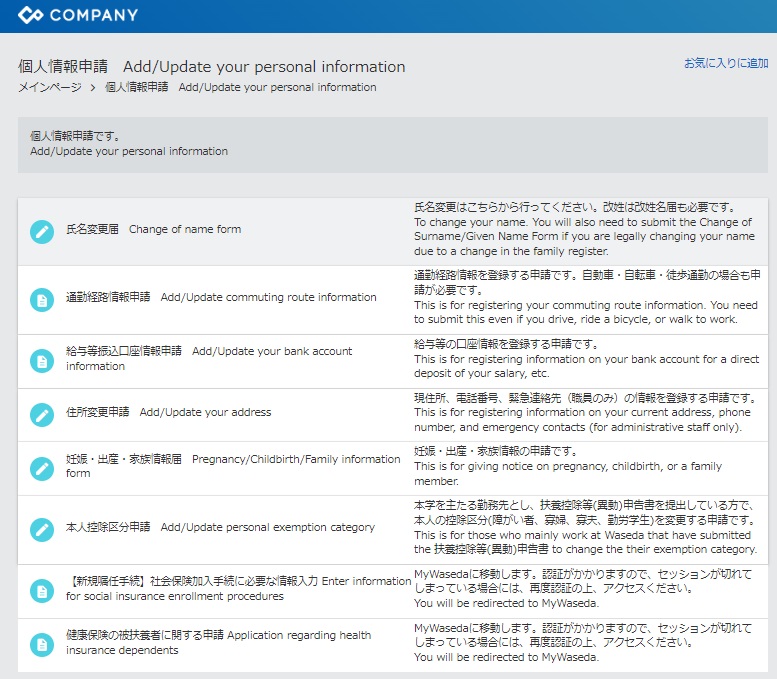

Application Screen

Select the items to be changed.

・If there is a change in the person’s… 住所変更申請

・If there is a change in the person’s declaration of deduction (e.g., widow, person with disability, etc.) … 本人控除区分申請

・If there is a change in spouse or dependents (marriage, birth of a child, etc.)… 妊娠・出産・家族情報届

In each screen, please click “次へ” when you have finished entering the information. Clicking the “一時保存” button will not submit your application.

![]()

A confirmation screen will appear. Scroll to the bottom of the screen and click the “Submit” button.

![]()

※You are not required to apply for a family member whose “控除区分” is “控除対象外”.

This deduction is eligible only to salaried workers whose salary income exceeds 8.5 million yen and who have a child under 23 years of age or special disability (for themselves or a family member). Please refer to the explanation from National Tax Agency and be sure to register your family members if applicable.

*This deduction system started in 2020. In order to apply for the deduction, you will need to register your family information even if you were not required to do so before.

Note: Unlike the deduction for dependents, this deduction is not restricted to apply to only one of the earners in the same household. Thus, for example, if both spouses have income of more than 8.5 million yen, and they have one dependent child under 23 years of age between them, both of them can apply for this deduction.

Dependents residing outside of Japan

If you wish to make a year-end tax adjustment for a relative residing outside of Japan as a tax-deductible person, you are required to submit the original documents related to the relative and the remittance documents every year.

Relatives temporarily residing outside of Japan for study or other reasons are considered relatives residing outside of Japan if the period of residence is scheduled to be one year or longer. If the required documents are not submitted by the deadline, the deduction cannot be applyed in the year-end adjustment (those eligible as of October 1 have been notified separately).

For details on required documents, please refer to Step1. Confirmation of registration information.

Reference: Request for submission of documents to apply for Tax Exemption for Dependents

Family Dependent Allowance (some qualifications only) 親族扶養手当

Unlike under the tax law, the maximum amount of income for a family member who is eligible for Family Dependent Allowance(親族扶養手当) is no more than 1,030,000 yen per year (no more than 85,833 yen per month), including all non-taxable income, etc. If you have not yet applied for the allowance, please follow the instructions below.

妊娠・出産・家族情報届 > 親族扶養手当申請(支給開始・停止)

- Eligibility: Professor, Associate Professor, Lecturer (full-time), teacher, and full-time staff