2-1. Step 2: File a insurance premium tax credit

## The following pages have been translated by a machine translation system.

## Please note that the machine translation system does not guarantee 100% accuracy.

After completing the information entered in “Step1.登録情報を確認する”, You will see “Step2.保険料控除を申告する” on the Application for Premium Tax Credit form application screen.

*If you have purchased only group insurance at Waseda University, enter only the name and relationship of the policyholder and beneficiary, and then click “Next” at the bottom of the screen.

*If you do not have any insurance, click “Next” at the bottom of the screen and you are done.

If you have Waseda university’s group insurance (*), your group insurance information is already registered. Please register only the name and relationship of the policyholder and beneficiary as additional information.

※Insurance purchased via the union is not registered; DC’s payroll deduction matching contribution is registered as a small business mutual aid and does not require registration.

Insurance Premium Deduction Procedure

The premium tax credit return must be printed and sent with a written proof of deduction.

- Apply via the web

- Return the printed application form on the last screen and the proof of deduction in the return envelope.

- Enter the details of your individual premium tax credit

- life insurance deduction(生命保険控除)

- Deduction for long-term care medical insurance(介護医療保険控除)

- Personal annuity control except(個人年金控除)

- damage insurance deduction(損害保険控除)

- National Pension Insurance premiums(国民年金保険料)

- deduction for social insurance premiums(社会保険料控除)

- Small Businesses and Economical Entities Linked to Monetary Control(小規模企業共済等掛金控除)

If you want to interrupt your input, press the “一時保存” button at the bottom of the screen.

Next time you want to continue with the application, click the “再 開” button.

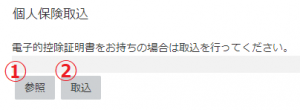

Importing electronic data for personal insurance (if you have an electronic certificate)

If you have your deductible certificate in electronic form, please import it from this screen. Please contact your insurance company for instructions on how to obtain a digital certificate. (Currently, only few insurance companies offer this service.)

If all the certificates of deduction for the insurance to be claimed are certificates in electronic form, it is not necessary to send the application form and certificate of deduction for insurance premiums to Salaries and Welfare Section.

1.Group Insurance Premiums

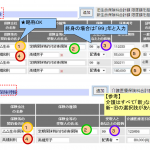

●For group insurance through the University, the “Name of Insurance Company”, “Premium Differential”, and “Period” are already entered. Group coverage is indicated as “(Group)” in “Insurance Type” or “Annuity Type”.

●Please enter the name of the policyholder (the person who is paying the premiums), the name of the beneficiary (if there is more than one policyholder, please enter the name of one of the beneficiaries; if unknown, please enter “*” (asterisk)), and the relationship (if unknown, please enter “本人”).

●No certificate is required for the premiums of “Group Insurance”.

※On the screen, the period of “Group Insurance” is set to “0-zero”, but you do not need to fill in.

2.Individual Insurance Premiums

●If you have your own personal insurance, you will need to enter the amount and send a certificate.

●If you are paying the premiums by yourself, you can declare if all of the beneficiaries are you or your spouse/other relatives, even if you are not the policyholder.

●The Certificate of Insurance Premium Deduction issued by the insurance company must be stapled to the back of the printed premium deduction form.

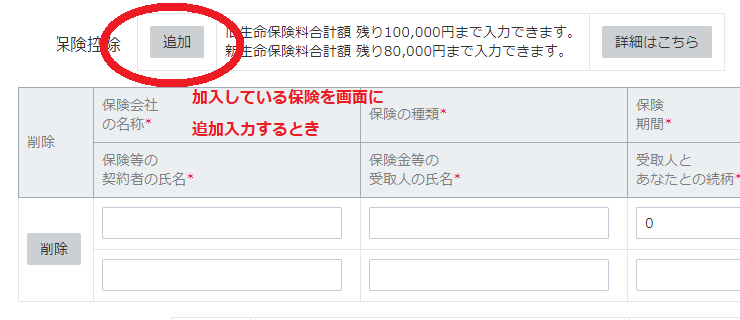

(Common to all insurance policies)How to add a policy to be entered

On each insurance entry screen, press the “追加” button to add a newinsurance.

There is a limit to the amount you can use for deductions. If you exceed the limit, you will see the following message.

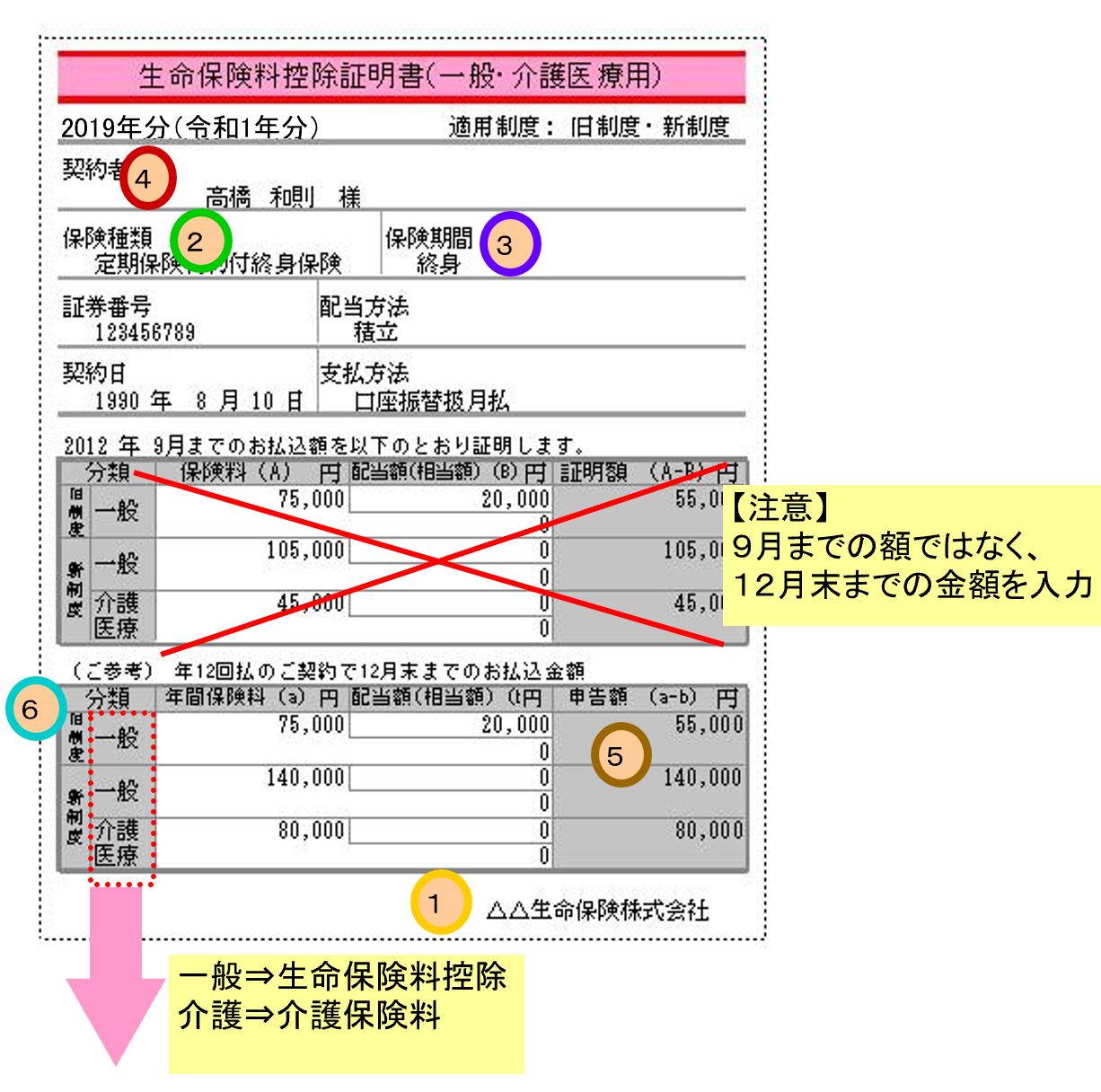

Life insurance premium deduction and long-term care medical insurance

(生命保険料控除および介護保険料控除)

Please use the Certificate of Deduction for Insurance Premiums sent by your insurance company as a guide.

※If the number of characters in the name of the insurance company exceeds 10 characters, an error will occur. You can omit the name of the insurance company if it exceeds the number of characters.

※Long-term care insurance premiums paid to the municipality (excluding University payroll deductions) fall under “social insurance premium deductions”, not here.

Paper Premium Deduction Certificate and Input Correspondence Example

Enter the amount at the end of December.

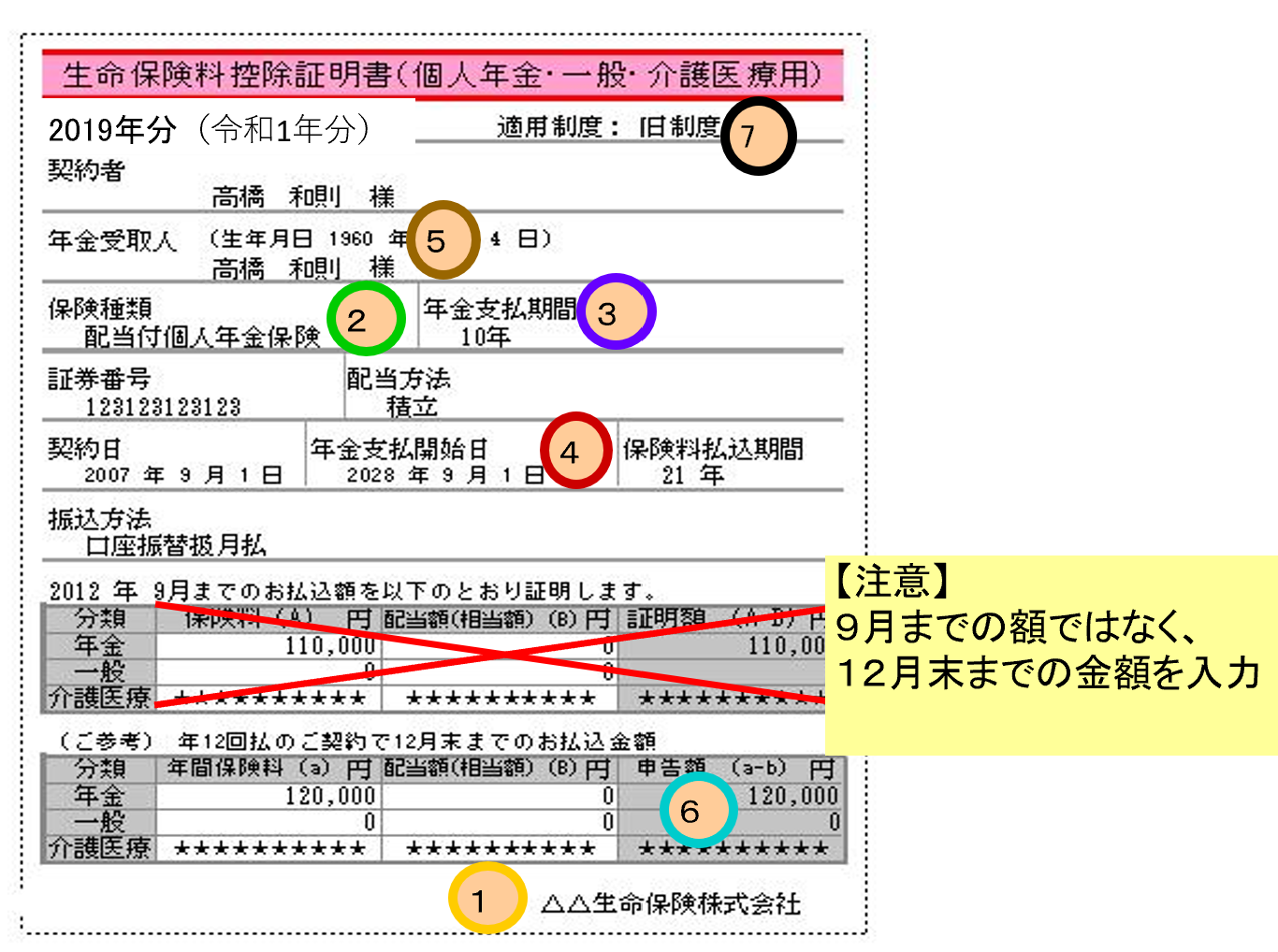

Individual Annuity Insurance(個人年金保険料)

Paper Premium Deduction Certificate and Input Correspondence Example

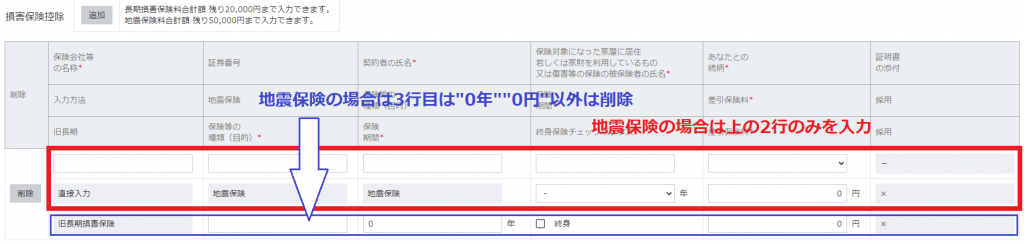

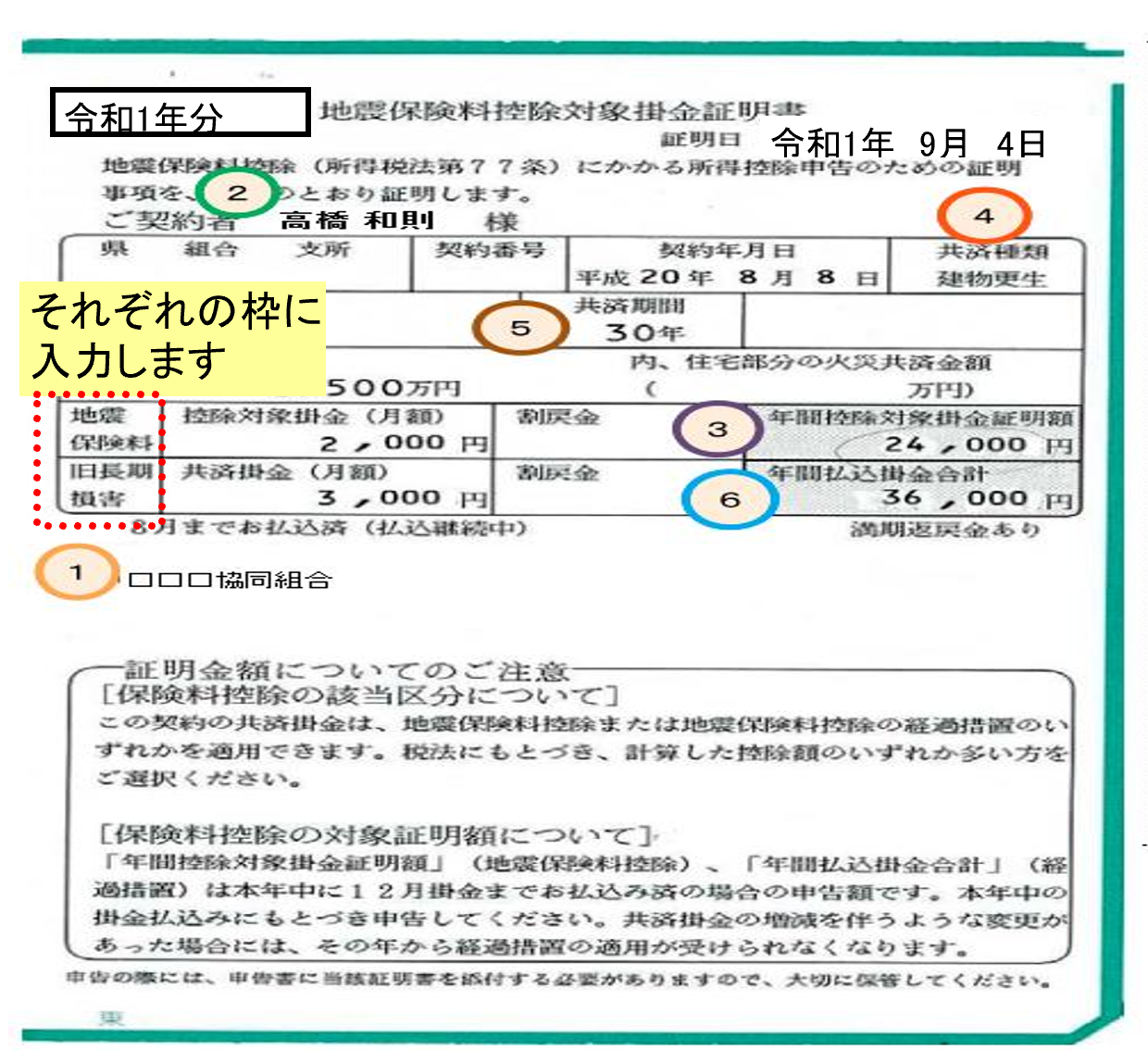

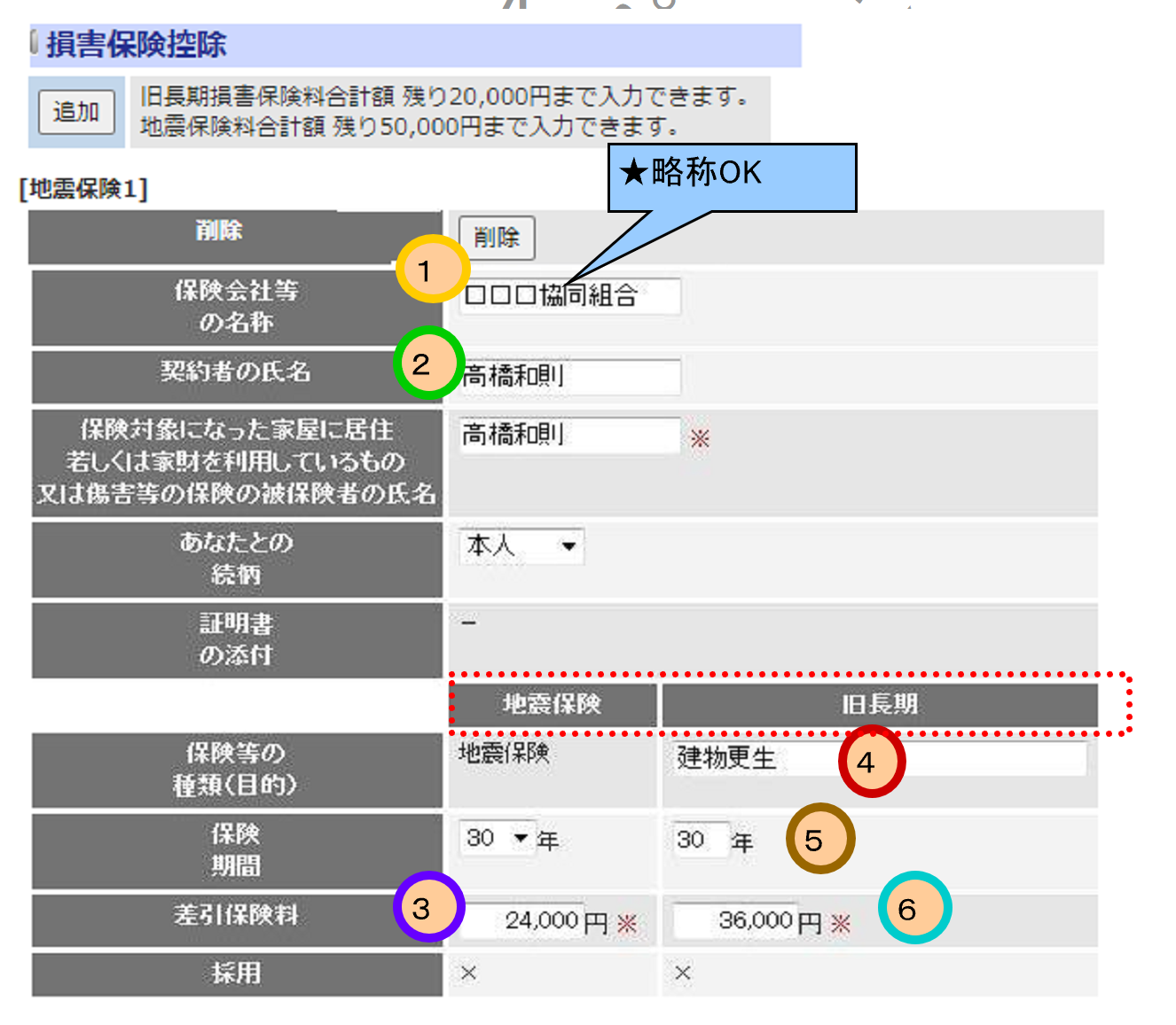

Earth quake insurance (damage insurance)

地震保険料(損害保険)

※If the number of characters in the name of the insurance company exceeds 10 characters, an error will occur. You may omit the name of the insurance company if it exceeds the number of characters.

Paper Premium Deduction Certificate and Input Correspondence Example

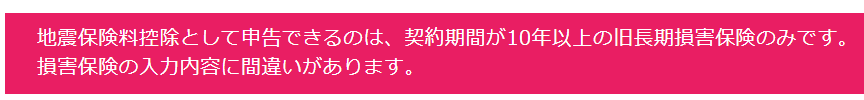

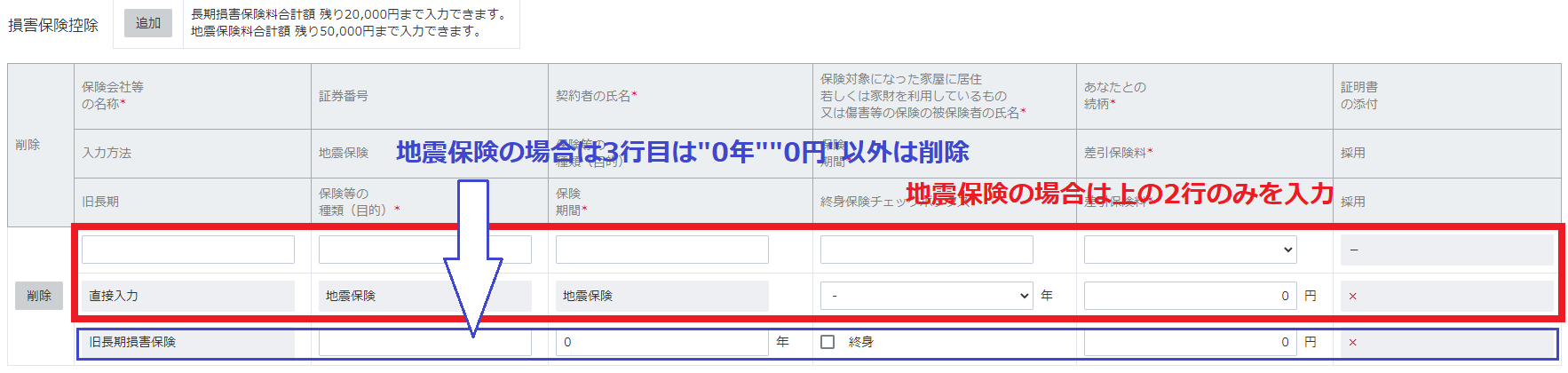

【注意】次のエラーが出る場合

地震保険を入力しようとしてこのエラーが出る場合、旧長期損害保険料の行の入力を削除する必要があります。非常にわかりにくく申し訳ございません。

一つの商品につき、3行あり、上2行が地震保険料、下1行が旧長期損害保険の入力欄になっています。

地震保険の場合は、3行目について、0年・0円となっているところ以外(保険等の種類、差し引き保険料など)の入力をすべて削除ください。

If you get this error when you try to enter earthquake insurance, you will need to delete the entry in the old long-term property insurance premium line(旧長期損害保険). We apolpgize for confusing.

There are three lines for each product, the top two lines are for earthquake insurance premiums, and the bottom line is for old long-term property insurance. In the case of earthquake insurance, please delete all entries except for the third line where it says “0 year” or “0 yen” (type of insurance, premium deducted, etc.).

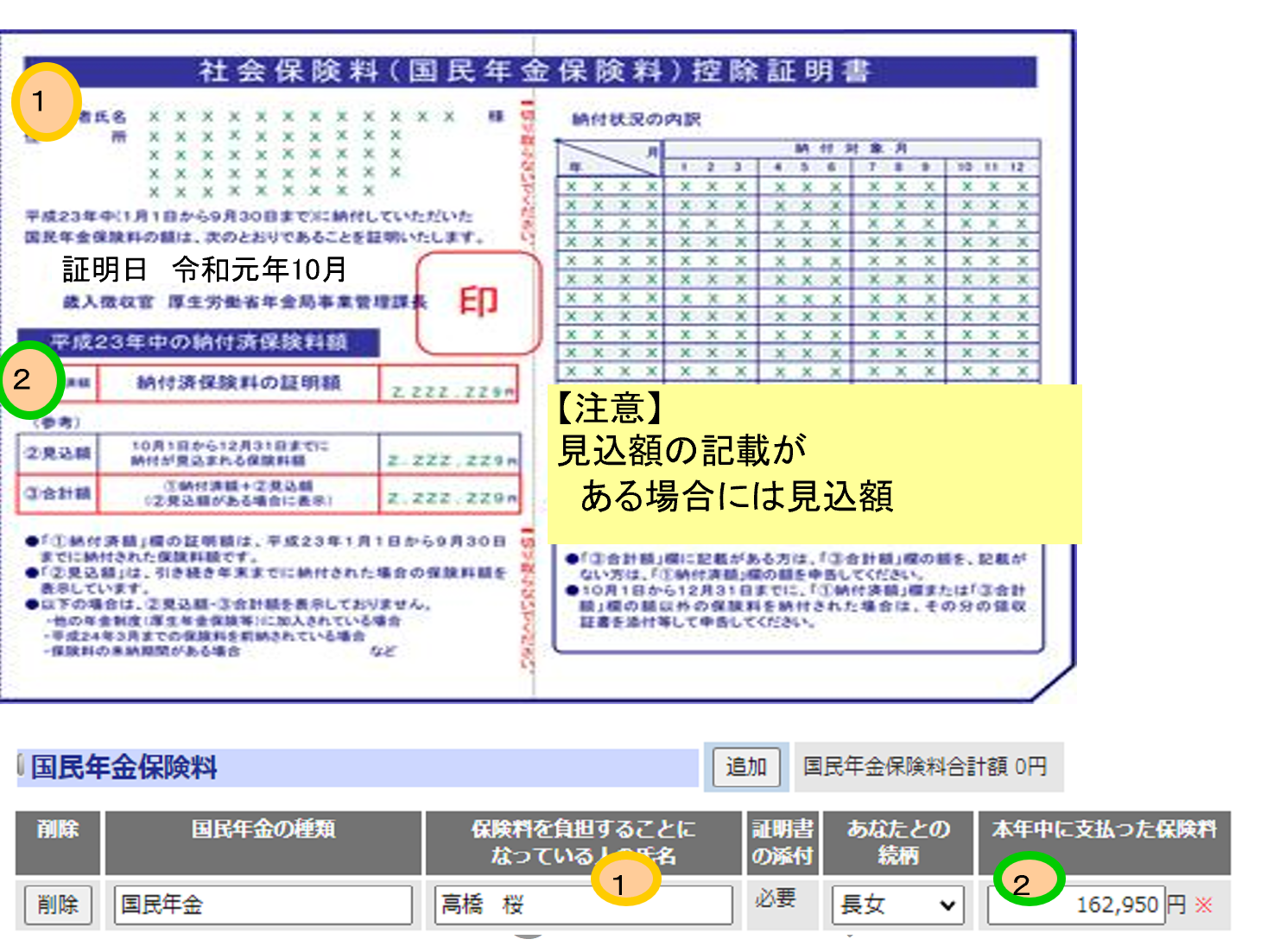

National Pension Insurance premiums(国民年金保険料)

If you have paid National Pension Insurance premiums directly to your municipality, please enter the amount you paid during the year.

Paper Premium Deduction Certificate and Input Correspondence Example

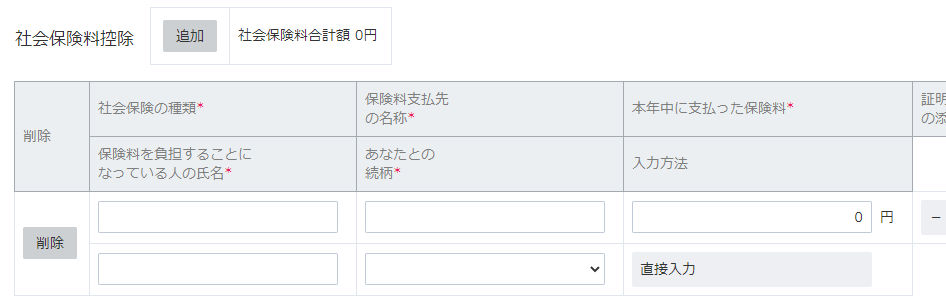

deduction for social insurance premiums(社会保険料控除)

If you have National Health Insurance or Nursing Care Insurance premiums paid directly to your municipality, please enter the amount you paid during the year. You cannot enter the amount of premiums of salary deductions.

※You cannot enter any long-term care insurance premiums that are directly deducted from your public pension you receive. This is because they are included in the withholding tax form of your public pension. Please note that if it is entered incorrectly, you will be required to file a tax return.

Likewise, you cannot enter the premiums for National Health Insurance and Nursing Care Insurance that are directly deducted from the public pension or other benefits received by your spouse or other relatives who live in the same household.

※The declared amount of “Long-term care insurance premiums” is not the total amount of the “Notice of Determination of Long-Term Care Insurance Premiums (介護保険料決定通知書) for 2023” sent from the municipality, but the total amount of payment (total amount of bank debits) from January 2023 to the end of December 2023.

小規模企業共済等掛金控除

If you have a premium for an individual defined contribution pension plan (iDeCo), please enter the amount you paid for it in the “個人型年金加入者掛金” section.

If you are a member of the University’s defined contribution corporate pension plan (DC plan) and have made matching contributions, the total amount of participant premiums for the period from January 2023 to December 2023 will be automatically incorporated into your year-end adjustment, so please do not input the amount that is deducted from your salary.

If you have other premiums, please enter them in the appropriate fields.

Confirmation of Input Information

When you have finished entering the information, click on “自動計算する” at the bottom of the screen.

Once you click on “自動計算する”, you will be taken to the top of the screen. If there are any errors, a message will be displayed, so please correct them.

Please check the “合計額”, “控除額細目” and “控除額” at the bottom of the screen as they will be calculated.

All information are collect, press “次へ”.

If you wish to interrupt your work, click “一時保存” button.

If you want to start a new application again, click “再 開” button.

【NOTICE】

Only enter the premiums you paid during 2023 on your premium tax credit return. You can report the premiums you are paying, even if you are not the policyholder, if all of the beneficiaries are you or your spouse/other relatives.

- The maximum amount of deduction for life insurance premiums for general life insurance, long-term care insurance and individual annuities is 120,000 yen in total.

- Deduction for general life insurance premiums and deduction for individual annuity insurance premiums is calculated by treating policies concluded on or after January 1, 2012 as “new policies(新契約)” and policies concluded on or before December 31, 2011 as “old policies(旧契約)”.

- Please make sure you have all the certificates ready before submitting them.

※If the number of characters in the name of the insurance company exceeds 10 characters, the system will generate an error. You may omit the name of the insurance company if it exceeds the number of characters.