3-1. Step 3.File a Home acquisition deduction

## The following pages have been translated by a machine translation system.

## Please note that the machine translation system does not guarantee 100% accuracy.

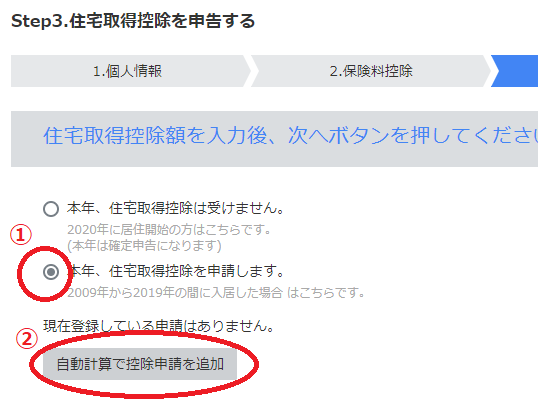

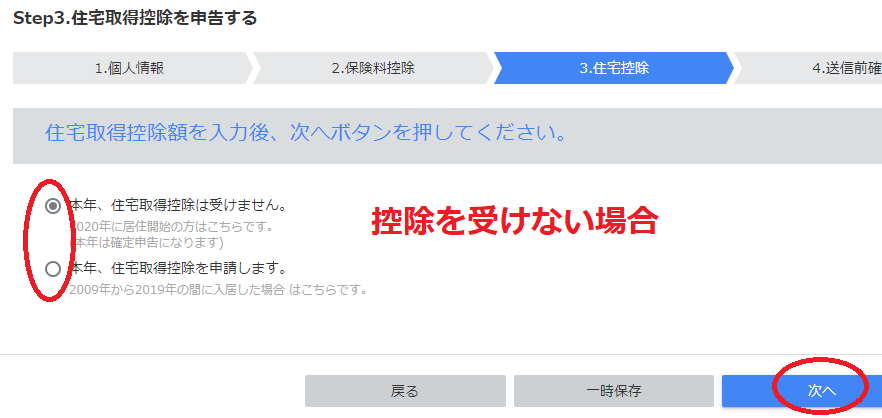

After completing the entry of “Step2. 保険料控除を申告する” and clicking the [Next] button, ”Step3.住宅取得控除を申告する” screen for claiming the deduction for home acquisition is displayed.

If you do not claim Home acquisition deduction, please select “本年、住宅取得控除は受けません。” and click “次へ”.

Home Acquisition Deduction Procedure

The home acquisition deduction requires tax return(確定申告) for the first year. Deduction cannot be made through year-end adjustments.

If you want to claim the home acquisition deduction in the second or subsequent years, please prepare the tax return form issued to you by the tax office and follow the procedures.

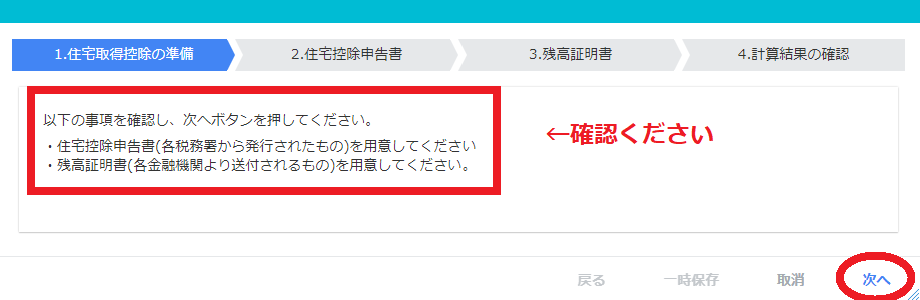

In addition to the web-based application, the home acquisition deduction tax return requires you to send in a printed application form and certificate.

- Apply from MyWASEDA.

- Send the declaration form and balance certificate in a return envelope.

※Along with the printed declaration form and the “住宅借入金等特別控除申告書” issued by the tax office, please be sure to send the “Year-End Balance Certificate for Homeownership(住宅取得資金に係る年末残高等証明書)” issued by financial institutions.

What to do on this screen

- Declaration of Domestic Citation(住宅控除申告書)

- Year-End Balance Certificate(残高証明書)

- Confirmation of calculation results

If you want to stop in the middle of the application, click the “一時保存” button at the bottom of the screen.

If you want to start a new application again, click the “再 開” button at the bottom of the screen.

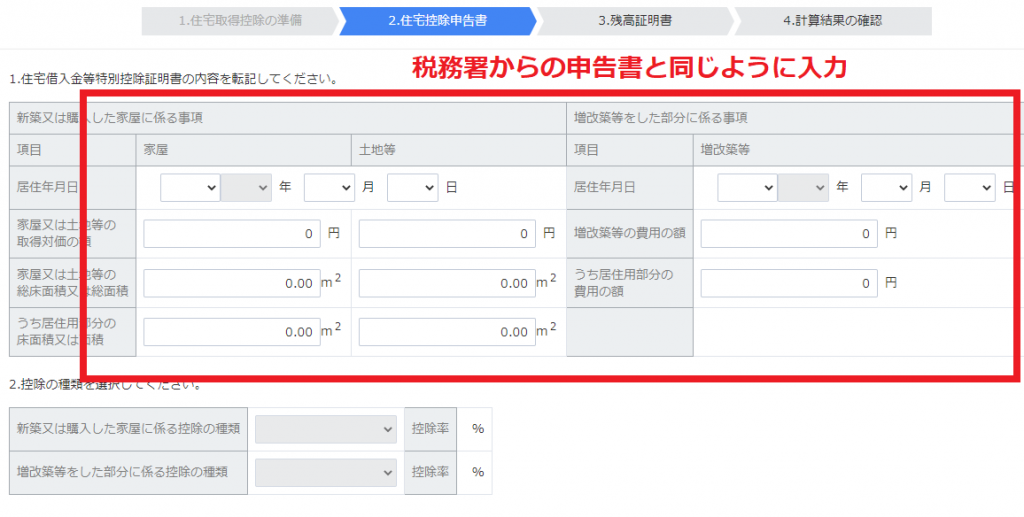

2. Submit 住宅控除申告書

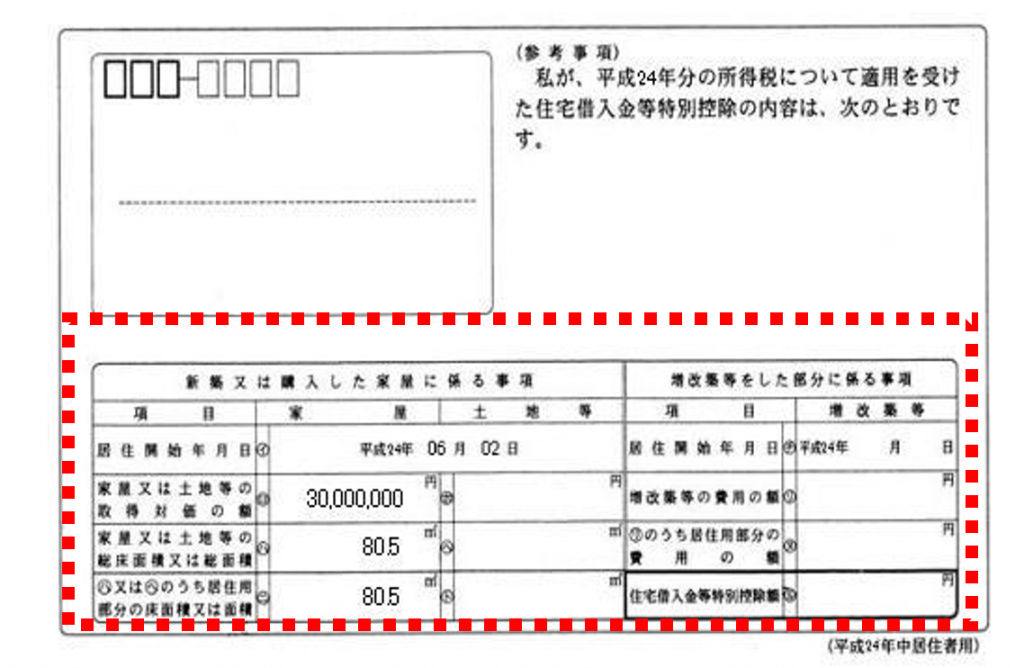

The tax return issued by the tax office

Input screen

Enter the information in the input screen in the same way as the 住宅控除申告書 from the tax office.

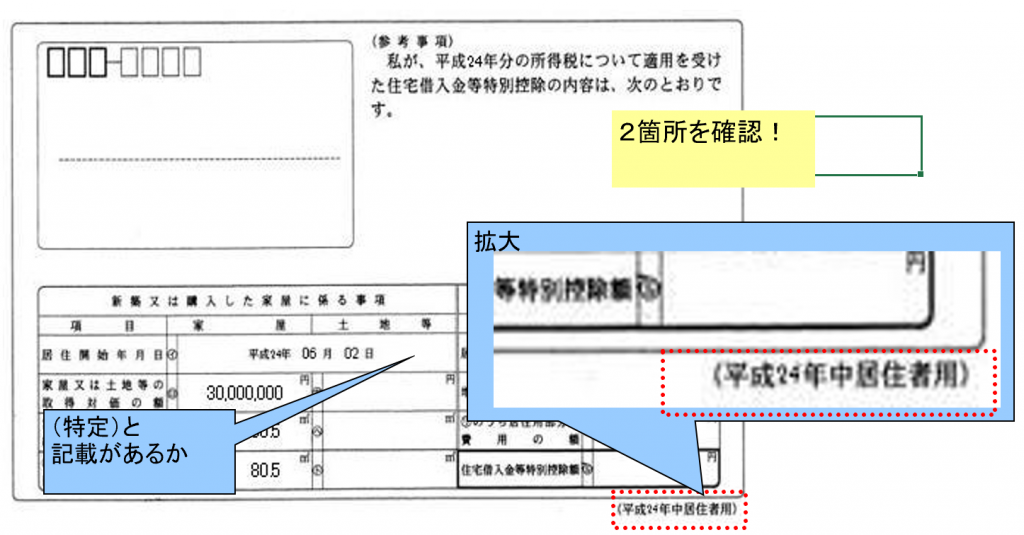

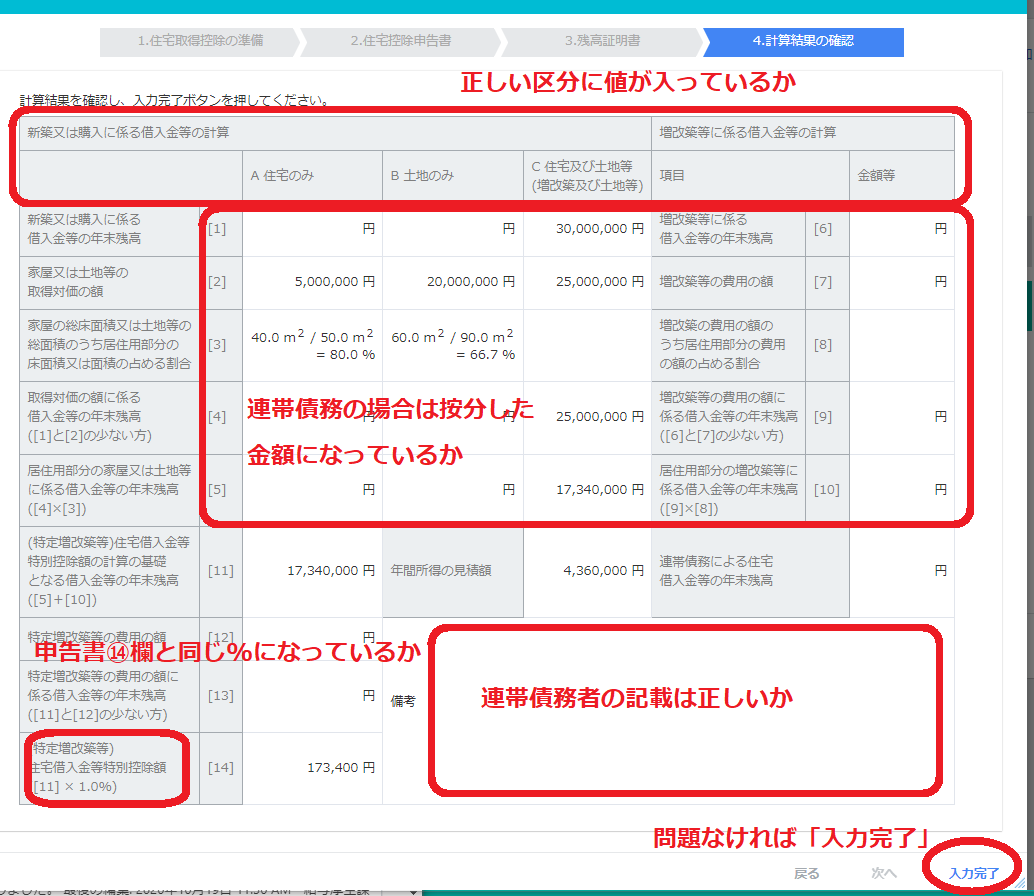

Check the classification

There are several classifications for the special exemption for home loans. The deduction rate and maximum amount varies depending on the classification, so be sure to check the information at the bottom of your tax return.

The tax return issued by the tax office

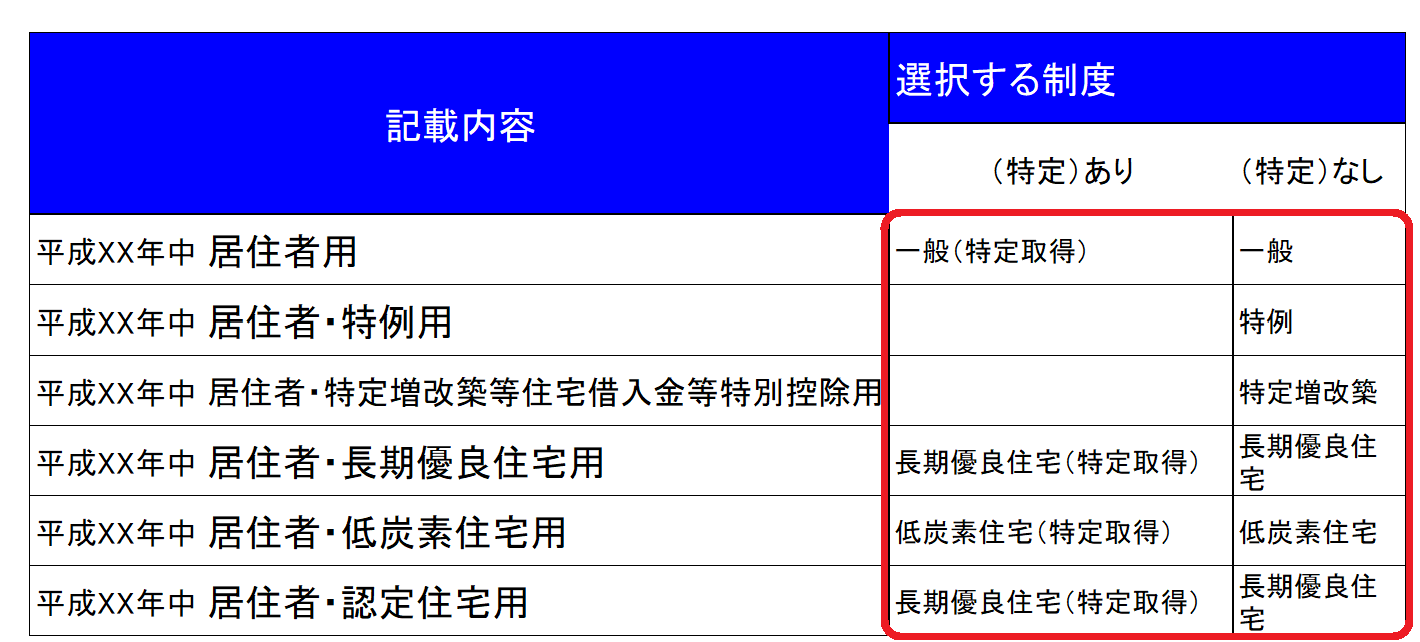

classifications

Fit the following table to the system you choose from the above declaration

Input on screen

Select the system you have applied from the table on the screen.

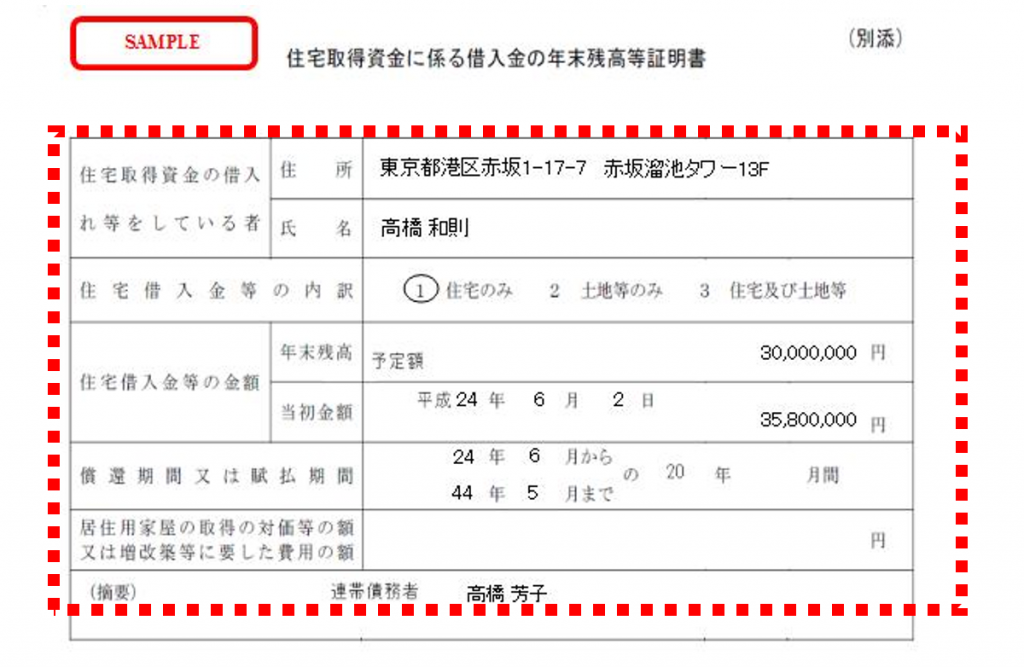

3.Year-End Balance Certificate(残高証明書)

Enter the details of the balance certificate sent by your bank on the screen.

Year-End Balance Certificate

Input screen

If all information is collect, click “次へ”.

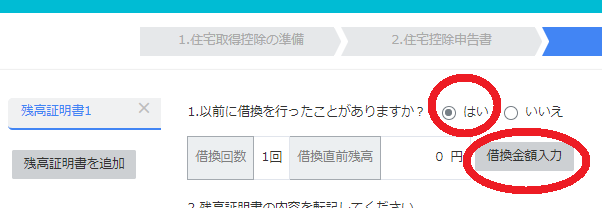

If you have refinanced

If you have “refinanced(借換)” your home loan during the current year, check the box on the screen for “はい” and enter the details of your balance certificate.

Please attach a refinancing statement (showing the outstanding principal balance at the time of refinancing) of the loan prior to refinancing. Depending on the amount of borrowing after refinancing, a portion of your year-end balance may be reduced. The reduction will be the same for next year and beyond.

Check your registration information

After you complete the web application to the end of the process, you will be required to send in your printed Declaration of Deduction and balance certificate.

Declaration of Deduction (issued by the tax office)

Please fill in your faculty/staff number to the tax form issued by the tax office.

※If you obtained your ”my number” during 2014, please do not fill out the “My Number (Personal Number)” section.

- For the first year of the deduction, you must file a tax return at the local tax office where you live.

- From the second year onwards, if you meet the requirements, you can receive a deduction at the year-end adjustment. Please stamp the current year’s tax return sent by the tax office and submit it for the year 2022 (平成35・令和5) only. Please write your faculty/staff number in the space above the “給与の支払者の名称(氏名)” column.

- In the “住宅取得控除の登録について” screen of “住宅控除申告書”, please enter the date and number printed at the bottom of the declaration form issued by the tax office (Certificate of Special Credit for Home Loan, etc. for Year-end Adjustment).

【NOTICE】

- If there is a joint and several obligor for the housing loan, enter the name, address, name and address of the employer, and the percentage of the burden, and get a seal. If the joint obligor is not a salaried employee, enter “なし(none)” for the name and address of the employer.

- Please be sure to send “住宅取得資金に係る年末残高等証明書“ by financial institutions and public institutions as an attachment. If you are a user of the University’s housing construction subsidy loan system and are eligible for this deduction, please request the balance certificate from the Salary and Welfare Section and attach it to your application form.To request the balance certificate, please email zandaka@list.waseda.jp.

- If you received “住宅借入金等特別控除” at another business last year as a result of the year-end adjustment, and you are receiving the same credit at the University this year, and the date you started living in Japan is before 2010, please obtain a reissue of the “年末調整のための住宅借入金等控除証明書” at the tax office and attach it to your “住宅借入金等特別控除申告書” (reissue is not required if the date you started living in Japan is after 2011).

Request for a Year-End Balance Certificate for Faculty and Staff Housing Construction Loan

To request the balance certificate, please email (zandaka@list.waseda.jp).

| Q1 | ”住宅借入金等特別控除申告書” is not in the envelope in which it was distributed. |

| A1 | ”住宅借入金等特別控除申告書” is not distributed by the university.After the first year’s tax return for the deduction, your local tax office will send you a batch of tax returns for the deduction period. |

| Q2 | I accidentally put it on a different year’s return. |

| A2 | You cannot use a different year’s return because the deduction amount is different for each year. Please fill in the current year’s tax return newly. If you make a mistake in your tax return, you can delete the incorrect information with a double line and use it for the corresponding year. |