0-2. Application Process

## The following pages have been translated by a machine translation system.

## Please note that the machine translation system does not guarantee 100% accuracy.

1.What is the year-end adjustment?

The year-end adjustment is a procedure for settling the excess or deficiency between the annual tax amount and the monthly income tax amount after determining the total salary for the year (January 1 to December 31).

Those who have submitted a “Application for (Change in) Exemption for Dependents” to Waseda University and whose total income for this year is 20 million yen or less are eligible. (Those earning over 20 million yen need to file a final tax return.)

please declare the amount of various deductions in this process. Even if you do not declare insurance premiums or dependents, it is necessary to apply for all year-end adjustment procedure.

If you are filing a tax return, you will need to submit a declaration of exemption for dependents for the next fiscal year. If there are no problems after confirming your information and that of your spouse and family, proceed to “Submission” in “Step 4: Confirmation of application details” without entering the deduction for insurance premiums and housing acquisition.

2.Application Process and Deadlines

The web application process is as follows

0.Log in to the HR system from MyWaseda

Login to MyWaseda

Home tab > Left menu [人事システム] > 申請・照会 > サービスメニュー[扶養控除等申告書一括申請(年末調整)].

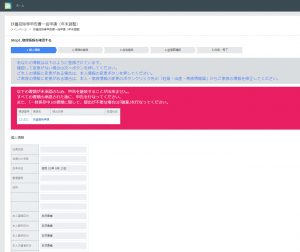

On the “扶養控除等申告書一括申請(年末調整)” screen, follow the steps below to apply.

- Step 1: Confirmation of registration information

Make sure that your information is up to date on the “Step 1”. If the information is not up-to-date, apply for the change of the family information, and after the change is reflected, enter the income amount of the individual and the family.

You cannot mofidy the information directly from this screen. You need to apply from 「本人・家族情報の変更」link at the bottom of the screen.

For details, please see “Step 1Confirmation of registration information. - Step 2: File the deduction for insurance premium

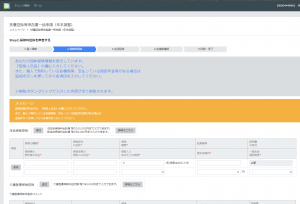

Enter and confirm the details of your application for the insurance premium deduction on the “Step 2: File a Deduction” screen, and calculate the deduction amount automatically.

For details, please see “Step 2. File a insurance premium deduction”. - Step 3.File a Home acquisition deduction

On the “Step 3. Declaring the Housing Acquisition Deduction” screen, those who wish to apply for the special deduction for housing loans are required to enter and confirm the details of their application, and the deduction amount will be calculated automatically

For details, please see ”Step 3.File a Home acquisition deduction”. - Step 4: Confirm the details of your application and click “Send”

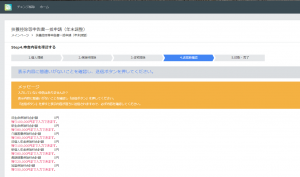

On the “Confirm the details of your application and click “Send”” screen, check that all the information you have entered up to this point is correct, and if it is correct, send your application.

For detalis, please see “Step 4: Confirm the details of your application and click “Send”” - Submit a paper deduction or housing loan balance certificate to the Salaries and Welfare Section

If you have documents to submit, such as a paper deduction certificate or a year-end housing loan balance certificate, click the “印字イメージPDF” button to print, staple the documents together and send them to the Salaries and Welfare Section.

3.Application Period for Year-End Adjustment

The application period for the year-end adjustment is as follows

If you are unable to complete the application within this period, you will be required to file your tax return by yourself.

<faculty> October 27, 2023(Fri.) 9:00am – November 14, 2023(Tue.) 3:00pm

<staff> October 20, 2023(Fri.) 9:00am – November 7, 2023(Tue.) 3:00pm

*The application period is different for faculty and staff.